Overview

We have certainly had our share of turbulent waters in the estate planning world from 2020-2022. With two significant elections, it is hard to remember a previous time with such substantial uncertainty about how tax planning and estate planning would evolve. That uncertainty required estate planners and their clients to be especially nimble, creative to a degree not seen before (more on that in a moment), and ready to act. Some clients indeed acted, while others waited to see how the tides might turn.

2023 told a different story. For the first time in a few years, there was less uncertainty with respect to changing laws — in large part because the Democrats control the Senate while the Republicans control the House, and 2023 was not an election year. The political arena was well-established, and the split in legislative control meant that large substantive changes were unlikely.

Nevertheless, 2023 was far from quiet. While the waters were calm, quiet water enabled quicker movement. In just over two years, current tax exemption limits are set to be cut in half. Many of our clients used the relative calm of 2023 to implement (or supplement) the same creative planning objectives that were born from the 2020- 2022 uncertainty. Indeed, if 2020-2022 taught us anything, it was that well-thought-out estate planning can have tremendously positive effects on families. And sometimes, the best ideas develop when the time crunch is real.

Yet, looking ahead, we see storm clouds building that have the potential to bring about vast change. A significant election is less than a year away. As the inflation-adjusted exemption threshold continues to climb, it illustrates just how advantageous it is to fully maximize lifetime gifting strategies while we are certain we still can. And who knows if some of the tried and true estate planning strategies will be around forever. Sticking with our stormy waters metaphor, we can sum up 2023 as time used to batten down the hatches because we expect 2024 and 2025 will bring the return of the turbulence from our recent past.

What follows is our review of developments and guidance on how to best prepare.

Inflation-Adjusted Tax Figures

The Tax Cuts and Jobs Act (the TCJA), which was signed into law on December 22, 2017, and most of which became effective on January 1, 2018, has proven to have many implications for domestic corporate and individual income tax, as well as federal gift, estate and generation-skipping transfer (GST) tax, fiduciary income tax and international tax. Since the TCJA’s enactment, various technical corrections have been issued, as has the Internal Revenue Service’s (IRS) guidance on certain aspects of the new tax regime. In light of the TCJA and recent IRS guidance, it is important to review existing estate plans consider future planning to take advantage of the increased exemption amounts (which – importantly – are presently set to sunset on January 1, 2026, at which time, absent legislative action, the prior exemption amounts (indexed for inflation, using the chained CPI figure) will be returned to), and maintain flexibility to allow for future strategic planning. In prior editions of our Year-End Estate Planning Advisories, we included detailed discussions of the TCJA and its important estate planning components. If you wish to review a more thorough analysis of the TCJA and other recent legislation like the Build Back Better Act and the Inflation Reduction Act, please see our most recent advisories for 2022 and 2021.

Federal Estate, GST and Gift Tax Rates

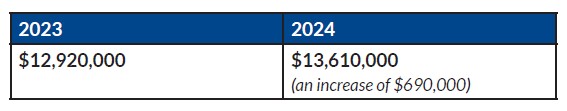

The federal estate, gift and GST applicable exemption amounts are as summarized below. In simple terms, these dollar figures represent the amount of wealth that each individual can transfer during their lifetime and/or at death (in the aggregate) before incurring any federal transfer taxes (which currently are assessed at a rate of 40 percent):

The federal estate tax exemption that applies to non-resident aliens was not increased under the TCJA. Under current law, the exemption for non-resident aliens remains at $60,000 (absent the application of an estate tax treaty).

Annual Gift Tax Exclusions

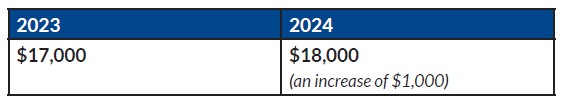

Each year, individuals are entitled to make gifts to each donee using the “Annual Exclusion Amount” without incurring gift tax or using any of their applicable exemption amount against estate and gift taxes. The Annual Exclusion Amount is as follows:

Thus, in 2023, a married couple together can gift $34,000 to each donee without gift tax consequences (consider doing so before the end of the year if you have not done so yet!). In 2024, they will be able to gift $36,000 together (consider doing so early in the year to remove as much income from and appreciation to the gifted property as possible). To make gifts together, spouses can agree to split the gift by consenting to gift splitting on a timely filed gift tax return.

For those with noncitizen spouses, please note that the limitation on tax-free annual gifts made to noncitizen spouses will increase from $175,000 in 2023 to $185,000 in 2024.

Federal Income Tax Rates

There are presently seven individual income tax brackets, with a maximum rate of 37 percent. The 37 percent tax rate will affect single taxpayers whose income exceeds $578,125 in 2023 ($609,350 in 2024) and married taxpayers filing jointly whose income exceeds $693,750 in 2023 ($731,200 in 2024).

The threshold for the imposition of the 3.80 percent surtax on net investment income and the 0.90 percent Medicare surtax on earned income is $200,000 for single taxpayers, $250,000 for married taxpayers filing jointly, and $14,450 for trusts and estates in both 2023 and 2024 (except that the trusts and estates threshold will increase to $15,200 in 2024).

Estates and trusts will reach the maximum rate with taxable income of more than $14,450 in 2023 ($15,200 in 2024).

Expatriation Related Increases

Someone who expatriates will be considered a “covered expatriate” (among other tests that are not inflation adjusted) if he or she has an average annual net income tax, for the five-year period preceding the expatriation date, that is greater than $201,000 in 2024 (up from $190,000 in 2023).

The exclusion amount from net unrealized gain in a covered expatriate’s property, which will be subject to an exit tax as if the covered expatriate had sold his or her worldwide property for fair market value on the day before terminating his or her residency, is $866,000 in 2024 (up from $821,000 in 2023).

Corporate Transparency Act Reporting Begins January 1, 2024

The Corporate Transparency Act (CTA) comes into effect January 1, 2024, and requires a “Reporting Company” (described below) to disclose specific information regarding itself, its “Beneficial Owners” (described below), and its “Company Applicants” (described below) to the US Treasury Department’s Financial Crimes Enforcement Network (FinCEN). The underlying purpose of the CTA is to curb illicit activity by non-transparent entities.

It is critical to recognize that reporting requirements for millions of Reporting Companies begin just a few weeks from the publication of this advisory. In general, a “Reporting Company” means a domestic or foreign corporation, limited liability company, or other similar entity that registers with a United States State or Tribal Office and is not otherwise exempt from the CTA’s reporting requirements. Based upon the foregoing registration requirement, trusts do not meet the definition of a Reporting Company. There are currently 23 limited exceptions. Nevertheless, the scope of the CTA is quite extensive.

A Reporting Company is required promptly to submit to FinCEN reports regarding (i) the Reporting Company, (ii) its Beneficial Owners (i.e. individuals that have substantial control over a Reporting Company and/or individuals that directly or indirectly own or control at least 25 percent, in the aggregate, of the total “ownership interests” (which is broadly construed) of a Reporting Company), and (iii) its Company Applicants (i.e. individuals who file the required registration and individuals who are primarily responsible for directing or controlling such filing). A comprehensive overview of the CTA detailing Reporting Companies, Beneficial Owners, Company Applicants, and Beneficial Ownership Information can be found here.

As mentioned above, there are limited, specific exemptions from the definition of a Reporting Company. A full list of those 23 exemptions is contained in the link referenced immediately above. Notably, Family Offices are not specifically exempted from the definition of a Reporting Company. However, the following exemptions from the definition of a Reporting Company may be pertinent in the Family Office/Private Wealth arena:

- Large Operating Company: Taxable entities that (a) employ more than 20 employees on a full-time basis in the United States, (b) filed in the previous year federal income tax or information returns in the United States demonstrating more than $5,000,000 in gross receipts or sales in the aggregate (on a consolidated basis, if applicable), and (c) have an operating presence at a physical office within the United States.

- Banks: A registered bank as defined in Section 3 of the Federal Deposit Insurance Act, Section 2(a) of the Investment Company Act of 1940, or Section 202(a) of the Investment Advisers Act of 1940 (e.g., certain private trust companies).

- Investment Advisor: Registered investment advisors under the Investment Adviser Act of 1940 (e.g., certain multi-family offices).

- Tax-Empty Entity: Organizations described in Section 501(c) of the Internal Revenue Code of 1986 (Code) (e.g., a private foundation).

- Subsidiary: Any entity whose ownership interests are controlled or wholly owned, directly or indirectly, by an exempt entity (other than money services business, pooled investment vehicles, or entities assisting a tax-exempt entity). Note that this exemption is interpreted narrowly and does not include parent companies, holding companies, or other affiliates of exempt entities.

- Inactive Entities: Entities formed before January 1, 2020, that (a) are not engaged in an active business, (b) are not owned by a foreign person, (c) have not experienced a change in ownership in the preceding 12-month period, (d) have not sent or received funds in an amount greater than $1,000 in the preceding 12-month period, and (e) do not otherwise hold any assets.

While trusts are not independently considered Reporting Companies, these types of trusts can be Beneficial Owners of Reporting Companies — either under the substantial control test or the ownership test described above. For those trusts that qualify as a Beneficial Owner of a Reporting Company, the analysis regarding reportable individuals “looks through” to the following specific individuals:

- A beneficiary, if such beneficiary (a) is the sole permissible recipient of income and principal or (b) has the right to demand distributions or withdraw substantially all trust assets.

- A trust’s grantor, if such grantor has the right to revoke the trust or otherwise withdraw the assets of the trust.

- Trustees or other individual(s) with the authority to control or dispose of trust assets.

Despite numerous comments requesting clarification, the CTA’s final regulations (as of the publication of this advisory) do not provide clarity with respect to what specific individuals fall into the category of “other individuals who can dispose of trust assets” (e.g., Trust Protectors, Business Advisors, Distribution Committees, or Investment Advisors). Thus, a key takeaway with respect to identifying which individuals are reportable when trusts are Beneficial Owners of a Reporting Company is that the specific terms of the trust need to be closely examined and analyzed.

Reporting Companies are required to report the following information about themselves to FinCEN: (a) full legal name, (b) any trade name or d/b/a, (c) their principal place of business (or, in the case of a foreign Reporting Company, its primary location in the United States), (d) the State, tribal, or foreign jurisdiction of formation (and in the case of a foreign Reporting Company, the State or tribal jurisdiction where it fire registers), and (e) a unique taxpayer ID number. Moreover, Reporting Companies are required to report the following information about their Beneficial Owners and Company Applicants to FinCEN: (v) full legal name of such individual, (w) date of birth of such individual, (x) the current address of such individual, (y) a unique ID number for such individual such as an unexpired passport number or driver’s license, and (z) an image of the document from which such unique ID number was obtained. Any changes to such information must be promptly reported to FinCEN. Ultimately, the burden to report such information (collectively, “Beneficial Ownership Information”) lies with the Reporting Company.

The timeline for reporting Beneficial Ownership Information for a Reporting Company varies based on the company’s formation date. Note that in late September 2023, FinCEN proposed an amendment to its reporting rule to provide that, solely with respect to entities formed or registered during calendar year 2024, such entity will have 90 days to submit its initial report to FinCEN. As of the publication of this advisory, such amendment has not been finalized. Assuming such amendment is finalized prior to January 1, 2024:

- For Reporting Companies formed before January 1, 2024: all Beneficial Ownership Information is required to be submitted to FinCEN not later than January 1, 2025.

- For Reporting Companies formed on or after January 1, 2024, but before January 1, 2025: all Beneficial Ownership Information is required to be submitted to FinCEN within 90 calendar days of formation.

- For entities formed on or after January 1, 2025: all Beneficial Ownership Information is required to be submitted to FinCEN within 30 calendar days of formation.

Note that updates to Beneficial Ownership Information (e.g., the replacement of a manager or director, a new address for a Beneficial Owner, or a sale or gift which shifts at least 25 percent of the ownership of a Reporting Company to a new individual/entity) are due within 30 calendar days of the change.

The determination of what entities are reportable under the CTA, which individuals are deemed Beneficial Owners, and what information must be reported is a fact-specific inquiry that involves an active review of the CTA, the applicable company structure, and the managers, directors, owners, and more for all such entities. This case-by-case determination becomes increasingly more complex with respect to identifying the reportable individuals in cases where a trust qualifies as a Beneficial Owner with respect to a Reporting Company. Depending on the company structure, as well as the applicable terms of any relevant trusts, this may require substantial resources to analyze correctly and adequately.

Important Planning Considerations for 2023 and 2024

Given the changes implemented by the TCJA, taxpayers should review their existing estate plans and consult with their tax advisors about how to best take advantage of, where appropriate, the higher exemption amounts while they are, in all events, available. The following is a summary of several items to consider.

Year-End Checklist for 2023

Before going into greater detail on available strategies, here is a short checklist of estate planning strategies that can be easily implemented before year-end:

- Make year-end annual exclusion gifts of $17,000 ($34,000 for married couples).

- Make year-end IRA contributions.

- Create 529 Plan accounts before year-end for children and grandchildren and consider front-loading the accounts with five years’ worth of annual exclusion gifts, taking into account the aggregate of any gifts made during the year to children and grandchildren.

- Pay tuition and non-reimbursable medical expenses directly to the school or medical provider.

- Consider making charitable gifts (including charitable IRA rollovers of up to $100,000, in certain circumstances) before year-end to use the deduction on your 2023 income tax return.

Review Formula Bequests

Many estate plans use “formula clauses” that divide assets upon the death of the first spouse between a “credit shelter trust,” which utilizes the client’s remaining federal estate tax exemption amount, and a “marital trust,” which qualifies for the federal estate tax marital deduction and postpones the payment of federal estate taxes on the assets held in the marital trust until the death of the surviving spouse. While the surviving spouse is the only permissible beneficiary of the marital trust, the credit shelter trust may have a different class of beneficiaries, such as children from a prior marriage. With the TCJA’s increase in the exemption amounts, an existing formula clause could potentially fund the credit shelter trust with up to the full federal exemption amount of $12,920,000 in 2023 and $13,610,000 in 2024. This formula could potentially result in a smaller bequest to the marital trust for the benefit of the surviving spouse than was intended or even no bequest for the surviving spouse at all. There are many other examples of plans that leave the exemption amount and the balance of the assets to different beneficiaries. Depending on the class of beneficiaries of the credit shelter trust, if the taxpayer lives in a state where the federal and state exemption amounts are decoupled or not aligned, the taxpayer’s estate may inadvertently find itself subject to estate tax at the state level. Taxpayers should review any existing formula clauses in their current estate plans to ensure they are still appropriate given the increase in the federal exemption amounts and the implications of the potential sunset of these exemption amounts. In addition, taxpayers should consider alternative drafting strategies, such as disclaimers, to maintain flexibility in their plans.

Income Tax Basis Planning

Taxpayers should consider the potential tradeoffs of using the increased exemption amounts during their lifetimes to gift assets to others, as opposed to retaining appreciated assets until their death so that those assets receive a stepped-up income tax basis. Taxpayers may want to consider retaining low-basis assets, which would then be included in their taxable estates and receive a step-up in income tax basis, while prioritizing high-income tax basis assets for potential lifetime gift transactions. In addition, if a trust beneficiary has unused federal estate tax exemption, consideration should be given to strategies that would lead to low-income tax basis assets currently held in trust, and otherwise not includible in a beneficiary’s taxable estate, being included in the beneficiary’s taxable estate, such as:

- granting the beneficiary a general power of appointment over the trust assets;

- using the trust’s distribution provisions to distribute assets directly to the beneficiary so that the assets may obtain a step-up in basis upon the death of the beneficiary to whom it was distributed; or

- converting a beneficiary’s limited power of appointment into a general power of appointment by a technique commonly known as “tripping the Delaware tax trap.”

Consequently, the assets included in the beneficiary’s estate would receive a step up in income tax basis at the beneficiary’s death and would take advantage of the beneficiary’s unused federal estate tax exemption amount. Whether these techniques should be implemented depends on a careful analysis of the basis of the assets held in trust and the beneficiary’s assets and applicable exemption amounts and should be discussed with advisors.

529 Plan Changes

The TCJA expanded the benefits of 529 Plans for federal income tax purposes. Historically, withdrawals from 529 Plans have been free from federal income tax if the funds were used toward qualified higher education expenses. Under the TCJA, qualified withdrawals of up to $10,000 can now also be made from 529 Plans for tuition in K-12 schools. As a result, the owner of the 529 Plan can withdraw up to $10,000 per beneficiary each year to use towards K-12 education. The earnings on these withdrawals will be exempt from federal income tax under the TCJA. However, because each state has its own specific laws addressing 529 Plan withdrawals, and not all states provide that withdrawals for K-12 tuition will be exempt from state income taxes, taxpayers should consult with their advisors to confirm the rules in their respective states. A concern with 529 plans is that leftover funds no longer needed for educational purposes may be trapped in the account unless a penalty is paid when the account is withdrawn for a non-qualified purpose. SECURE 2.0 (discussed further below) permits a beneficiary of 529 accounts to roll over up to $35,000 over his or her lifetime from any 529 account into a Roth IRA.

Planning to Use Increased Federal Exemptions

Given that the increased federal exemption amounts are currently set to sunset at the end of 2025, it may be prudent to make use of these increased amounts before they disappear (with the caveat that the law may, of course, change prior to 2026, and as part of a deal to make other changes, the exemptions may remain where they are). While a change in the federal exemption amounts has not taken place so far under the Biden administration, it nevertheless may be prudent to make use of the increased amount in 2023 and/or 2024. We note that a change in the law can occasionally occur without much-advanced notice. Also, 2025 will be a very busy time for estate planners (and, where needed, appraisers). Accordingly, for individuals who plan to use their exemption prior to the end of 2025, we encourage you to complete that planning in 2024 to avoid the 2025 rush (plus, the sooner an individual acts, the more income from, and appreciation on, the transferred assets can accumulate outside of the taxable estate).

Gifting Techniques to Take Advantage of the Increased Applicable Exemption Amount

Taxpayers may want to consider making gifts to use the increased federal exemption amount. It is less expensive to make lifetime gifts than to make gifts at death because tax is not imposed on dollars used to pay gift tax, but estate tax is imposed on the dollars used to pay estate tax. In addition, taxpayers may benefit by removing any income from and appreciation on the gift from their estates. However, taxpayers should seek advice if they have used all of their applicable exemption amount and would pay federal gift tax on any gifts. Making gifts that result in significant gift tax payments may not always be advisable in the current environment.

A countervailing consideration of lifetime gifting is that the gifted assets will not get a step-up in basis upon death (as would assets held at death) and will thus generate capital gains tax if they are subsequently sold for an amount higher than their basis. The IRS released Revenue Rule 2023-02, which reiterated this previously well-established trade-off. Accordingly, the decision of whether and how to embark on a lifetime gifting strategy depends on a number of factors, including the bases of the transferor’s various assets, their projected income and appreciation, the total amount of the transferor’s assets, and the transferor’s remaining applicable exemption amount. For individuals with assets far exceeding their applicable exemption amounts, lifetime gifting of high-basis assets generally may be recommended. However, individuals with total assets close to or below their applicable exemption amounts should exercise caution before making gifts of low-basis assets. Instead, those individuals should consider holding their assets until death to achieve a step-up in basis upon death while minimizing estate taxes. Of course, maintaining a comfortable standard of living is a factor that also must be considered.

If undertaking a gifting strategy, gifts to use the increased exemption may be made to existing or newly created trusts. For instance, a taxpayer could create a trust for the benefit of the taxpayer’s spouse (a spousal lifetime access trust, or a “SLAT”) and gift assets to the SLAT using the taxpayer’s increased federal exemption amounts. The gifted assets held in the SLAT should not be includible in the taxpayer’s or spouse’s respective taxable estates, and distributions could be made to the spouse from the SLAT to provide the spouse with access to the gifted funds, if needed, in the future. Of course, marital stability and the health of the other spouse need to be considered. Additionally, gifts could be made by a taxpayer to dynasty trusts (to which GST exemption is allocated), which would allow the trust property to benefit future generations without the imposition of estate or GST tax.

Absent legislative reform, the federal applicable exemption amount will increase by $690,000 ($1,380,000 for a married couple) in 2024. Therefore, even if a taxpayer uses some or even all of the available applicable exemption amount before the end of 2023, additional gifts may be made in 2024 without paying any federal gift tax. Based on current law, the applicable exemption amount also will be adjusted for inflation in future years. Those residents in Connecticut should be mindful that Connecticut is the only state with a state-level gift tax; although the Connecticut state-level gift tax exemption was $9,100,000 in 2022, it matched the federal exemption level of $12,920,000 ($25,840,000 for married couples) in 2023. New York residents, on the other hand, should be mindful that, notwithstanding the fact that New York does not have a state-level gift tax, generally gifts made within three years of death are added back to the decedent’s taxable estate for New York state estate tax purposes.

Other Techniques to Take Advantage of the Increased Applicable Exemption Amount

In addition to making gifts to use the increased exemption, below is a summary of several other broadly applicable recommendations:

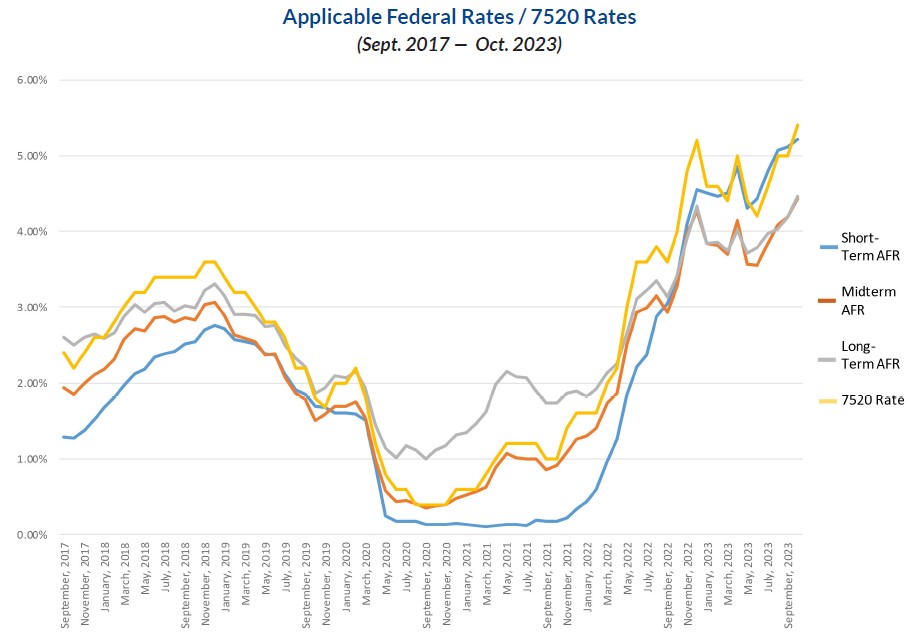

- Sales to Trusts. Taxpayers should also consider using the increased federal exemption amounts through gifts to grantor trusts followed by sale transactions to such grantor trusts for a down payment and a note for the balance. The increased federal exemption may provide a cushion against any asset valuation risk attendant with such sales. Taxpayers who enter into such sale transactions should consider taking advantage of the adequate disclosure rules to start the three-year statute of limitations running. Taxpayers should also note,however, that the Fiscal Year 2024 Greenbook (discussed below) is proposing changes to sale transactions to grantor trusts. Interest rates on promissory notes are presently at high rates but generally are still advantageous to engage in this type of transaction. For illustrative purposes, please see the below chart that shows just how dramatically interest rates have risen in the past few years.

- Loan Forgiveness/Refinancing. If taxpayers are holding promissory notes from prior estate planning transactions, from loans to family members, or otherwise, they should consider using some or all of the increased federal exemption amounts to forgive these notes. Consideration could be given to refinancing existing notes, but given the higher interest rates, that may not be advantageous at present.

- Allocation of GST Exemption to GST Non-Exempt Trusts. If a taxpayer’s existing estate plan uses trusts that are subject to GST tax (GST non-exempt trusts), consideration should be given to allocating some or all of the taxpayer’s increased GST exemption amount to such trusts.

- Balancing Spouses’ Estates. For married taxpayers, if the value of the assets owned by one spouse is greater than the increased federal exemption amounts and greater than the value of the assets owned by the other spouse, consideration should be given to transferring assets to the less propertied spouse. Such a transfer would provide the less propertied spouse with more assets to take advantage of the increased federal exemption amounts, especially the increased GST exemption, which is not portable to the surviving spouse upon the first spouse’s death. Taxpayers should be mindful, however, that transfers to non-US citizen spouses are not eligible for the unlimited marital deduction for federal gift tax purposes, and such transfers should stay within the annual exclusion for such gifts ($175,000 in 2023; $185,000 in 2024) to avoid federal gift tax. Additionally, creditor protection should be considered before transferring assets from joint name or from one spouse’s name to the other spouse’s name. Note that the annual exclusion for gifts (to donees other than a spouse) is $17,000 in 2023 and $18,000 in 2024.

- Life Insurance. Taxpayers may wish to review or reevaluate their life insurance coverage and needs with their insurance advisors.

Review and Revise Your Estate Plan to Ensure it Remains Appropriate

As noted above, any provisions in wills and trust agreements that distribute assets according to tax formulas and/ or applicable exemption amounts should be reviewed to ensure that the provisions continue to accurately reflect the testator’s or grantor’s wishes when taking into account the higher applicable exemption amounts. Consideration should also be given to including alternate funding formulas in wills or trust agreements that would apply if the federal estate tax exemption amounts do, in fact, sunset in 2026.

Additionally, in light of the increased exemption amounts, taxpayers should also consider whether certain prior planning is now unnecessary and should be unwound, such as certain qualified personal residence trusts (QPRTs), family limited partnerships (FLPs) and split-dollar arrangements.

Allocation of GST-applicable exemption amounts should be reviewed to ensure that it is used most effectively if one wishes to plan for grandchildren or more remote descendants. In addition, because of increased GST exemption amounts available under the TCJA, allocation of some or all of one’s increased GST exemption amounts to previously established irrevocable trusts that are not fully GST exempt may be advisable.

Taxpayers should continue to be cautious when relying on portability in estate planning, as portability may not be the most beneficial strategy based on your personal situation. In addition, a deceased spouse’s unused exclusion (DSUE) may not be available upon remarriage of the surviving spouse. Furthermore, since the DSUE amount is frozen upon the first spouse’s death, no appreciation is allocated to the DSUE amount between the first spouse’s death and the surviving spouse’s subsequent death, which would limit the amount of transfer tax free assets that could pass to beneficiaries; however, when a credit shelter trust is used in lieu of portability, the appreciation on the assets funding the credit shelter trust will inure to the beneficiaries’ benefits. However, portability may be a viable option for some couples with estates below the combined exemption amounts. Portability can be used to take advantage of the first spouse to die’s estate tax exemption amount, as well as obtain a stepped-up basis at each spouse’s death. Portability can also be used in conjunction with a trust for the surviving spouse (a QTIP trust) in order to incorporate flexibility for post-mortem planning options. Factors such as the asset protection benefits of using a trust, the possibility of appreciation of assets after the death of the first spouse to die, the effective use of both spouses’ GST exemption, and state estate tax should be discussed with advisors in determining if relying on a portability election may be advisable. For taxpayers looking to make a portability election, effective July 8, 2022, Rev. Proc. 2022-32 provides certain taxpayers with a more simplified method to make the portability election, allowing them to be able to elect portability of a DSUE up to five years after the decedent’s date of death.

Unmarried couples should continue to review and revise their estate planning documents and beneficiary designations. Since the advent of same-sex marriage, it is now clear that domestic partners, even if registered as such, do not qualify for the federal (and in many cases state) tax and other benefits and default presumptions that are accorded to married couples.

Finally, in view of the potential sunset of many pertinent provisions of the TCJA, estate plans should provide for as much flexibility as possible. As noted above, formula bequests should be reviewed to ensure they are appropriate under current law, and consideration should be given to granting limited powers of appointment to trust beneficiaries to provide flexibility for post-mortem tax planning. A Trust Protector (or Trust Protector committee) may also be appointed to give a third party the ability to modify or amend a trust document based on changes in the tax laws or unforeseen future circumstances or to grant certain powers to trust beneficiaries that may have tax advantages under a new tax regime (such as the granting of a general power of appointment to trust beneficiaries in order to obtain a stepped-up basis in trust assets at the beneficiary’s death).

Mitigate Trust Income Tax and Avoid the Medicare Surtax With Trust Income Tax Planning

Non-grantor trusts should consider making income distributions to beneficiaries. Trust beneficiaries may be taxed at a lower taxed rate, especially due to the compressed income tax brackets applicable to non-grantor trusts. Additionally, a complex, non-grantor trust with undistributed annual income of more than $12,500 (adjusted for inflation) will be subject to the 3.8 percent Medicare surtax. However, some or all of the Medicare surtax may be avoided by distributing such income directly to beneficiaries who are below the individual net investment income threshold amount for the Medicare surtax ($200,000 for single taxpayers, $250,000 for married couples filing jointly and $125,000 for married individuals filing separately).

Careful evaluation of beneficiaries’ circumstances and tax calculations should be made to determine whether trusts should distribute or retain their income.

Transfer Techniques

Many planning techniques used in prior years continue to be advantageous under the TCJA. Due to the potential sunsetting of many applicable provisions of the TCJA, consideration should be given to planning that minimizes the risk of paying current gift taxes but still allows taking advantage of the increased exemptions amounts to shift assets and appreciation from the taxable estate. Additionally, consideration should be given to selling hard-to-value assets due to the increased exemption available to “shelter” any valuation adjustment of these assets upon audit. Lifetime gifting and sales transactions remain very important in providing asset protection benefits for trust beneficiaries, shifting income to beneficiaries in lower tax brackets, and providing funds for children or others whose inheritance may be delayed by the longer life expectancy of one’s ancestors.

Grantor Retained Annuity Trusts

Grantor-retained annuity trusts (GRATs) remain one of our most valuable planning tools, though given recent higher interest rates, their practicality has decreased. Under current law, GRATs may be structured without making a taxable gift. Therefore, even if one has used all of his or her applicable exemption amount, GRATs may be used without incurring any gift tax. Because GRATs may be created without a gift upon funding, they are an increasingly attractive technique for clients who want to continue planning to pass assets to their descendants without payment of gift tax in the uncertain tax environment.

A GRAT provides the grantor with a fixed annual amount (the annuity) from the trust for a term of years (which may be as short as two years). The annuity the grantor retains may be equal to 100 percent of the amount the grantor used to fund the GRAT, plus the IRS-assumed rate of return applicable to GRATs (which for transfers made in November 2023 is 5.60 percent, which is up from November 2022’s rate of 4.80 percent). As long as the GRAT assets outperform the applicable rate, at the end of the annuity term, the grantor will be able to achieve a transfer tax-free gift of the spread between the actual growth of the assets and the IRS assumed rate of return. Although the grantor will retain the full value of the GRAT assets, if the grantor survives the annuity term, the value of the GRAT assets in excess of the grantor’s retained annuity amount will then pass to whomever the grantor has named, either outright or in further trust, with no gift or estate tax.

Sales to Intentionally Defective Grantor Trusts (IDGTs)

Sales to IDGTs have become an increasingly popular planning strategy due to the increased exemption amounts under the TCJA.

In utilizing a sale to an IDGT, a taxpayer would transfer assets likely to appreciate in value to the IDGT in exchange for a commercially reasonable down payment and a promissory note from the trust for the balance. From an income tax perspective, no taxable gain would be recognized on the sale of the property to the IDGT because it is a grantor trust, which makes this essentially a sale to one’s self. For the same reason, the interest payments on the note would not be taxable to the seller or deductible by the trust.

If the value of the assets grows at a greater pace than the prevailing applicable federal rate (which for sales in November 2023 is 5.30 percent for a short-term note, up from the applicable federal rate for a sale in November 2022 of 4.10 percent for a short-term note), as with a GRAT, the appreciation beyond the federal rate will pass free of gift and estate tax.

The increased federal exemption amounts may provide a cushion against any asset valuation risk attendant to such sales. Additionally, the increased exemption amounts permit the sale of a substantially larger amount of assets to grantor trusts. Typically, grantor trusts should be funded with at least 10 percent of the value of the assets that will be sold to the trust. With the higher exemption amounts, those who have not used any of their exemptions could contribute up to $12.92 million (or $25.84 million if splitting assets with a spouse) to a grantor trust in 2023. This would permit the sale of up to $129.2 million (or $258.4 million) of assets to the trust in exchange for a promissory note with interest at the appropriate AFR.

Consider a Swap or Buy-Back of Appreciated Low Basis Assets from Grantor Trusts

If a grantor trust has been funded with low-basis assets, the grantor should consider swapping or buying back those low-basis assets in exchange for high-basis assets or cash. If the grantor sold or gave (through a GRAT or other grantor trust) an asset with a low basis, when that asset is sold, the gain will trigger capital gains tax. However, if the grantor swaps or purchases the asset back from the grantor trust for fair market value, no gain or loss is recognized. The trust would then hold cash or other assets equal to the value of the asset that was repurchased. Alternatively, many grantor trust instruments give the grantor the power to substitute the trust’s assets with other assets, which would allow the low-basis assets to be removed from the trust in exchange for assets of equal value that have a higher basis. Then, on the grantor’s death, the purchased or reacquired asset will be included in the grantor’s taxable estate and will receive a step-up in basis equal to fair market value, eliminating the income tax cost to the beneficiaries. Those whose estates may not be subject to estate taxes due to the current high exemption amounts may utilize swaps or buy-backs to “undo” prior planning strategies that are no longer needed in today’s environment. Particular care should be taken when considering swapping hard-to-value assets. In that circumstance, an appraisal from a qualified appraiser should be obtained to support the valuation of the swapped assets. This not only helps limit fiduciary liability claims but also helps against an argument that the swap was not done for assets of equal value, which could potentially result in a gift being made by the grantor to the trust.

Consider the Use of Life Insurance

Life insurance presents significant opportunities to defer and/or avoid income taxes, as well as provide assets to pay estate tax or replace assets used to pay estate tax. Generally speaking, appreciation and/or income earned on a life insurance policy accumulates free of income taxes until the policy owner makes a withdrawal or surrenders or sells the policy. Thus, properly structured life insurance may be used as an effective tax-deferred retirement planning vehicle. Proceeds distributed upon the death of the insured are completely free of income taxes. Taxpayers should consider paying off any outstanding loans against existing policies in order to maximize the proceeds available tax- free at death, although potential gift tax consequences must be examined. Note that the decision to pay off such loans requires a comparison of the alternative investments that may be available with the assets that would be used to repay the loans and the interest rate on the loans.

Use Intra-Family Loans and Consider Re-Financing Existing Intra-Family Loans

While these techniques work better when interest rates are low, because the exemption amounts are so high, many techniques involving the use of intra-family loans should be considered, including:

- The purchase of life insurance on the life of one family member by an irrevocable life insurance trust, with premium payments funded by loans from other family members.

- The creation of trusts by older generation members for the benefit of younger family members, to which the older generation members loan funds. The spread between the investment return earned by the trust and the interest owed will create a transfer tax-free gift.

- Forgiving loans previously made to family members. The amount that is forgiven in excess of the annual gift tax exclusion amount will be a gift and thus will use a portion of one’s applicable gift tax and/or GST tax exemption amount. This may be a beneficial strategy considering the increased exemption amounts.

Installment Sale to Third-Party Settled GST Tax-Exempt Trust

Unique planning opportunities and transfer tax benefits may be available if a relative or friend of the taxpayer has an interest in creating and funding a trust for the benefit of the taxpayer and/or the taxpayer’s family. For example, a third-party grantor (e.g., a relative or friend of the taxpayer) could contribute cash to a trust for the benefit of the taxpayer, allocate GST tax exemption to that gift, and then that trust could purchase assets from the taxpayer in exchange for such cash and a secured promissory note in the remaining principal amount of assets purchased. While this sale could result in payment of capital gains tax to the taxpayer (ideally at an earlier, lower value), this planning could present the following potential benefits:

- there should be no transfer tax concerns for the third-party grantor if the grantor’s other assets, even when added to the value of the foregoing gift, would not be sufficient to cause the estate tax to apply at the grantor’s death (this depends on what the estate tax exemption amount is at the grantor’s subsequent death);

- the taxpayer could receive a step up in basis as of the date of the initial sale;

- the taxpayer could be a beneficiary, hold a limited power of appointment over and control who serves as trustee of the trust; and

- the appreciation in the value of the asset being sold from the date of the initial sale above the interest rate on the promissory note (e.g., 4.69 percent is the mid-term AFR for a sale completed in November 2023) would accrue transfer-tax-free for the benefit of the taxpayer and/or the taxpayer’s family; and

- the trust could be structured in such a way as to provide protection from the taxpayer’s creditors and remove the trust assets from the taxpayer’s and his/her family members’ taxable estates.

In order to achieve the foregoing benefits, it is important that only the third-party grantor makes any gratuitous transfers to the trust and that the third-party grantor not be reimbursed for any such transfers.

Consider Charitable Planning

A planning tool that is very effective in a high-interest rate environment is a Charitable Remainder Annuity Trust (CRAT), which combines philanthropy with tax planning. A CRAT is an irrevocable trust that pays an annual payment to an individual (typically the grantor) during the term of the trust, with the remainder passing to one or more named charities. The grantor may receive an income tax deduction for the value of the interest passing to charity. Because the value of the grantor’s retained interest is lower when interest rates are high, the value of the interest passing to charity (and therefore the income tax deduction) is higher.

Alternatively, a strategy that works better in a low-interest rate environment is a Charitable Lead Annuity Trust (CLAT). A CLAT is an irrevocable trust that pays one or more named charities a specified annuity payment for a fixed term. At the end of the charitable term, any remaining assets in the CLAT pass to the remainder, noncharitable beneficiaries. As with a GRAT, to the extent the assets outperform the IRS assumed rate of return, those assets can pass transfer-tax-free to the chosen beneficiaries. A CLAT may become an attractive option if interest rates fall.

Be mindful of the ability to make IRA charitable rollover gifts, which allows an individual who is age 70 1/2 or over to make a charitable rollover of up to $100,000 (adjusted for inflation, pursuant to SECURE 2.0, discussed next) to a public charity without having to treat the distribution as taxable income. Other types of charitable organizations, such as supporting organizations, donor-advised funds, or private foundations, are not eligible to receive the charitable rollover. Therefore, if a taxpayer needs to take a required minimum distribution, he or she may arrange for the distribution of up to $100,000 (adjusted for inflation) to be directly contributed to a favorite public charity and receive the income tax benefits of these rules. Due to new limitations on itemized deductions (i.e., the cap on the state and local tax deduction), some taxpayers may no longer itemize deductions on their personal income tax returns. Without itemizing deductions, these taxpayers could not receive the income tax benefit of a charitable deduction for charitable contributions.

Revised Actuarial Tables

On June 1, 2023, TD 9974 was published by the IRS, which finalized new actuarial tables that are used regularly for estate planning transactions where interests in annuities, life/term of years, or revisionary interests need to be valued. Between May 4, 2022, and June 1, 2023, taxpayers were able to choose using the new (but not yet final) valuation tables or the predecessor tables. Upon finalizing the new tables, the IRS agreed to allow tax returns to be amended that used the predecessor tables for transactions that occurred between May 1, 2019, and June 1, 2023. Accordingly, anyone who completed a transaction using the predecessor tables during that time period may wish to evaluate a potential amended tax return. The new valuation tables increase the longevity of the taxpayer, meaning that life interests have increased while remainder interests have decreased — and that can lead to more attractive planning opportunities.

SECURE 2.0 Act

The “SECURE 2.0 Act of 2022” was signed into law by President Biden on December 29, 2022, as part of the Consolidated Appropriations Act, 2023. SECURE 2.0 Act builds on the Setting Every Community Up for Retirement Enhancement (SECURE) Act of 2019, which fundamentally changed the laws regarding distributions from retirement accounts, both during the lifetime and after the death of an IRA account owner.

The SECURE Act increased the required beginning date (RBD) for when an IRA owner has to begin withdrawing required minimum distributions (RMDs) from a traditional IRA from 70 1/2 to 72. SECURE 2.0 Act further increases the RBD to age 73 starting on January 1, 2023, for those who turned 72 after December 31, 2022. SECURE 2.0 will further increase the RBD to age 75 starting on January 1, 2033. Before the change under SECURE 2.0, an IRA owner who turned age 72 (born in 1951) in 2023 would have an RBD of April 1, 2024. The increase in the RBD to age 73 means that IRA owners born in 1951 do not have RMDs for 2023; rather, those IRA owners will have RMDs for 2024, which must be withdrawn by April 1, 2025.

As a result, individuals who reach age 72 are not required to take RMDs from traditional IRAs in 2023; however, individuals who reach age 73 in 2023 will be required to take the first RMDs from traditional IRAs by April 1, 2024.

SECURE 2.0 creates new limited exceptions to the 10 percent additional tax imposed for certain distributions from traditional IRAs prior to the IRA owner attaining age 59 ½ with the goal of providing flexibility for workers who have unexpected emergency expenses.

The age 50 additional “catch-up” contributions for IRAs have been fixed at $1,000 for a number of years. Thanks to SECURE 2.0, beginning in 2024, the “catch-up” amount will be indexed for inflation. A new concept introduced by SECURE 2.0 is that 401K participants earning more than $145,000 (indexed for inflation) will be required beginning in 2024 to make any “catch-up” contributions into a designated Roth account. As a result, the contribution will be taxable.

Beginning in 2023, SECURE 2.0 brings welcomed changes to some rules regarding qualified charitable distributions (QCDs). Under current law, a QCD allows an IRA owner who is at least age 70 ½ (which SECURE 2.0 did not change) to direct up to $100,000 from his or her IRA per year to public charities. The QCD counts toward satisfying the year’s RMD obligation and is excluded from the IRA owner’s taxable income. The annual $100,000 QCD limit will also be indexed for inflation beginning in 2024.

SECURE 2.0 now allows a beneficiary of a 529 Plan to make a tax-free rollover of any remaining funds into a Roth IRA (not to exceed the annual Roth IRA contribution limit), provided that the 529 Plan account has been open for at least 15 years.

Before SECURE 2.0, the failure to take RMDs resulted in a penalty tax equal to 50 percent of the RMD amount. This amount could be waived by the IRS for reasonable cause, and the IRS routinely waived the penalty. SECURE 2.0 reduces the penalty to 25 percent of the RMD amount, and the penalty is further reduced to 10 percent if the IRA owner takes corrective action in a timely fashion.

On July 14, 2023, Notice 2023-54 announced that the Department of the Treasury and the IRS intend to issue final regulations related to RMDs under IRC Section 401(a)(9) that will apply no earlier than the 2024 distribution calendar year. In addition, Notice 2023-54 provides guidance related to certain provisions of IRC Section 401(a) (9) that apply for 2021, 2022 and 2023, in particular, that there will be no penalty for failure to take RMDs in 2021, 2022 and 2023 from inherited IRAs subject to the “10-year rule” under the SECURE Act. If a taxpayer has already paid an excise tax for a missed RMD, that taxpayer may request a refund of that excise tax. Notice 2023-54 provides additional rollover relief for IRA distributions made in the first half of 2023 that would have been RMDs if not for changes made in SECURE 2.0.

Important Federal Cases Decided in 2023

United States v. Paulson, 131 AFTR 2d 2023-1743 (9th Cir. May 17, 2023) [EP116-125]

Allen Paulson (the Decedent) died on July 19, 2000, survived by his third wife Madeleine Pickens (Madeleine), three sons from a prior marriage, Richard Paulson (Richard), James Paulson (James) and John Michael Paulson, and several grandchildren, including granddaughter Crystal Christensen (Crystal). Richard post-deceased his father and was survived by his wife, Vikki Paulson (Vikki). The Decedent’s gross estate, valued at approximately $200,000,000, was mostly held in a revocable trust (the Trust). Years after the Decedent’s death, following multiple disputes between the Decedent’s fiduciaries and beneficiaries, audit inquiries, and failed elections to defer payment of the Decedent’s federal estate taxes, roughly $10,000,000 of federal estate taxes, plus interest and penalties, remained unpaid. The United States ultimately brought suit against certain of the Decedent’s heirs in their capacities as trustees, transferees or beneficiaries (collectively, the “defendants”), alleging that they were personally liable for the Decedent’s unpaid estate tax liabilities pursuant to Code Section 6432(a)(2).

The United States Court of Appeals for the Ninth Circuit (the Court) ultimately reversed the lower court’s holding that the defendants were not personally liable for the unpaid estate taxes. In so holding, the Court was the first to interpret the provisions and legislative history of said Section 6432(a)(2) to determine its meaning. Code Section 6432(a)(2) imposes personal liability for a decedent’s estate taxes on transferees and others who receive or have property from an estate. It states, in relevant part:

“If the estate tax imposed by chapter 11 is not paid when due, then the spouse, transferee, trustee (except the trustee of an employees’ trust which meets the requirements of section 401(a)), surviving tenant, person in possession of the property by reason of the exercise, nonexercised, or release of a power of appointment, or beneficiary, who receives, or has on the date of the decedent’s death, property included in the gross estate under sections 2034 to 2042, inclusive, to the extent of the value, at the time of decedent’s death, of such property, shall be personally liable for such tax” (26 U.S.C. Section 6432(a)(2)).

One question before the Court was whether the limiting phrase “on the date of the decedent’s death” modifies only the preceding verb “has” or also the more remote verb “receives.” The Court ruled in favor of the United States that the phrase “on the date of decedent’s death” does not limit the verb “receives,” holding that Code Section 6432(a)(2) “imposes personal liability for unpaid estate taxes on the categories of persons listed in the statute who have or receive estate property, either on the date of the decedent’s death or at any time thereafter, subject to the applicable statute of limitations.”

In so ruling, the Court followed “the rule of the last antecedent,” which provides that a limiting clause should be read to modify only the noun or verb immediately before it. Contrary to the opinion of the single dissenting circuit judge, the Court also noted that to accept another interpretation would be contrary to the statutory text and context, even though it would be possible, under the decided interpretation, for the personal liability of an individual to exceed the value of the property received by them if such property had significantly declined in value after receipt. Overall, the Court felt there were sufficient safeguards preventing this remote possibility from materializing, especially considering the government’s affirmations that the personally liable transferee is only responsible to the extent of property actually had or received by such individual.

After settling that Code Section 6432(a)(2) imposes personal liability on those categories of persons listed in the statute who have or receive estate property on or after the date of the decedent’s death, the Court was tasked with determining whether the categories of people listed included the defendants. The Court held that Vikki, Crystal and James were successor trustees of the Trust and therefore liable for unpaid estate taxes in such capacity to the extent of the value of the property included in the Trust at the time of the Decedent’s death. The Court also found Crystal and Madeleine liable as beneficiaries of the Trust, finding more broadly, based on contextual case law and analogous statutory usage, that the term “beneficiary” as used in Code Section 6432(a)(2) included a “trust beneficiary.” The case was remanded to the district court to calculate the proportion of estate taxes owed by each individual personally liable.

As a practical result of Paulson, a nominated successor trustee may wish to inquire as to the liabilities of an estate or trust before accepting the role of trustee. Additionally, executors and trustees should consider withholding distributions until all estate or trust liabilities are satisfied. On the other hand, beneficiaries who receive distributions should learn whether there are any outstanding liabilities of the estate or trust before spending their receipts. In a case where the payment of estate tax was duly deferred, the timeline for observing these precautions may be extended.

Schlapfer v. Comm’r of Internal Revenue, T.C. Memo 2023-65

On May 22, 2023, the Tax Court issued a decision in Schlapfer v. Comm’r, T.C. Memo 2023-65, marking its first ruling on what constitutes adequate disclosure of a gift for gift tax purposes under Treas. Reg. 301.6501(c)-1(f)(2). By ultimately applying a “substantial compliance” approach to disclosure, the Tax Court favorably found that the taxpayer met the requirements for adequate disclosure despite not adhering to a stricter standard.

By way of background, Ronald Schlapfer (Taxpayer) had ties to both Switzerland and the United States. In connection with his career, in 1979, Taxpayer moved to the United States from Switzerland and obtained a non-immigrant visa, declaring his intention not to permanently reside in the United States. At the time, Taxpayer’s mother, aunt, brother and uncle, his only family, remained in Switzerland. Between 1979 and applying for US citizenship on May 18, 2007, Taxpayer was married, had children, got divorced, and in 1990, was re-married to his current wife (Mrs. Schlapfer) with whom Taxpayer had a son in 1992. Also, in 2002, Taxpayer started his own business, European Marketing Group, Inc. (EMG), a Panamanian corporation that managed investments, holding cash and marketable securities. At the time of EMG’s formation, Taxpayer owned all 100 issued and outstanding shares of common stock of EMG.

On July 7, 2006, Taxpayer applied for a LifeBridge Universal Variable Life Policy (the Policy). His stated purpose for taking out the Policy was to create and fund a policy that Taxpayer’s mother, aunt and uncle (his brother died in1994) could use to support Taxpayer’s nephews. Taxpayer was the initial owner of the Policy, the mother, aunt and uncle were named as the insured, and Taxpayer and Mrs. Schlapfer were designated as primary beneficiaries. On September 22, 2006, the Policy was issued. By November 8, 2006, Taxpayer had transferred $50,000 in cash and his 100 shares of EMG to an account in order to fund the premium payments on the Policy. On January 24, 2007, the Policy was assigned to Taxpayer’s mother as owner, and by May 31, 2007, the Policy had been irrevocably assigned to Taxpayer’s mother, aunt and uncle as joint owners.

As part of the Offshore Voluntary Disclosure Program (OVDP) meant to give US taxpayers with offshore assets an opportunity to comply with US tax reporting and payment obligations, in 2012, Taxpayer filed a Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return for year 2006, along with several supporting documents. One such document was a protective filing for the gift of 100 shares of EMG, described as a controlled foreign corporation, having a value of $6,056,686. The protective claim stated that the gift was not subject to gift tax because at the time the gift was made, Taxpayer did not intend to reside permanently in the United States. Taxpayer inaccurately reported the gift as a gift of EMG shares and not a gift of the Policy because he thought the Policy was an example of an entity that the OVDP instructions required to be disregarded upon filing. He also stated that the EMG shares were assigned to his mother, even though the ultimate assignment was to Taxpayer’s mother, aunt and uncle as joint owners. In June 2014, the IRS responded to Taxpayer’s OVDP submission with a request for additional documentation and information, to which Taxpayer timely responded in July 2014.

In January 2016, the IRS opened an examination of Taxpayer’s 2006 Form 709. Ultimately, after discussions and the IRS’s assertion that the gift was actually a gift of the Policy in 2007 (and not the EMG shares in 2006), the IRS issued a notice of deficiency claiming Taxpayer was liable for $4,429,949 of gift tax and $4,319,200 worth of additions to tax. Both the IRS and Taxpayer filed summary judgment motions with the court, with Taxpayer, on the other hand, asserting that the three-year limitations period applicable to the gift had run, given Taxpayer’s adequate disclosure of the gift on his 2006 Form 709. Accordingly, the question before the Tax Court was whether the gift in question, as reported on Taxpayer’s 2006 Form 709, satisfied the rules of adequate disclosure such that the statute of limitations had expired before the IRS claimed a deficiency.

Code Section 6501(c)(9) provides that the Commissioner may assess a gift tax at any time if a gift is not shown on a return unless the gift is “disclosed in such return, or in a statement attached to the return, in a manner adequate to apprise the Secretary of the nature of such item.” Prior case law provides that disclosure is considered adequate if it is “sufficiently detailed to alert the Commissioner and his agents as to the nature of the transaction so that the decision as to whether to select the return for audit may be a reasonably informed one” (Thiessen v. Commissioner, 146 T.C. 100, 114 (2014), quoting Estate of Fry v. Commissioner, 88 T.C. 1020, 1023 (1987)). Treasury Regulation 301.6501(c)-1(f)(2) provides that transfers reported on a gift tax return will be considered adequately disclosed if the return provides the following information: (i) a description of the transferred property and consideration received therefor; (ii) the identity of and relationship between each transferee and the transferor; (iii) if transferred in trust, the trust EIN and description its terms, or, in lieu of such a description, a copy of the trust instrument; (iv) a description of the method used to determine the fair market value of the transferred property; and (v) a statement describing any position contrary to any proposed, temporary or final Treasury regulations or revenue rulings.

The provisions of Code Section 6501(c)(9) and analogous Code provisions provide support that information relating to a gift disclosed on documents other than the gift tax return (for example, the supporting documents submitted through the OVDP), is properly considered when analyzing whether the gift was adequately disclosed. Additionally, in Treasury Decision 8845, the IRS provided that its express rejection of a “substantial compliance” approach did not mean “that the absence of any particular item or items would necessarily preclude satisfaction of the regulatory requirements, depending on the nature of the item omitted and the overall adequacy of the information provided.”

With this as background, the court held that the Taxpayer substantially complied with the requirements of Treas. Reg. 301.6501(c)-1(f)(2) such that the IRS was adequately apprised of the nature of the gift. With respect to requirement (i), even if Taxpayer failed to describe the gift correctly, stating the gift was of the EMG shares and not the Policy itself, he provided sufficient information regarding the underlying asset (i.e., the EMG shares), the value of which primarily comprised the value of the Policy. Regarding Taxpayer’s identification of the transferees and his relationship with them, the fact that he inaccurately stated only his mother as a transferee was held immaterial since the other transferees were also family members, and there would be no change to understanding the nature of the gift had his aunt and uncle been identified from the start. Finally, the financial reports of EMG that were provided with Taxpayer’s submission to the OVDP were sufficient to allow the court to determine the fair market value of the EMG shares. Thus, the court held that Taxpayer met the requirements for adequate disclosure, and, accordingly, the three-year statute of limitations, including extensions, had expired prior to the IRS’s issuance of the notice of deficiency.

Estate of Cecil v. Comm’r of Internal Revenue, T.C. Memo 2023-24 (Feb. 28, 2023)

Estate of Cecil dealt with the gift tax valuation of certain transferred shares of an S Corporation.

Mr. Cecil and Mrs. Cecil (together, Petitioners) were members of the family that built and owned the Biltmore House, an over four-acre, French Renaissance-style chateau in Asheville, North Carolina (the “Biltmore House”). In 1932, the Biltmore House and its surrounding property were contributed to the Biltmore Company (TBC), which, since 1982, has been classified as an S Corporation. TBC is an operating business in the tourism and hospitality industry, providing visitors an opportunity to enjoy a simulation of the Gilded Age through its tours, hotels, restaurants, retail stores and numerous outdoor activities. Over the years of operating TBC, the Cecil family had instituted various policies and agreements severely limiting the transfer of TBC shares in general and especially outside the family.

As permitted by the TBC operating agreement, in November 2010, Mrs. Cecil made a gift of her one share of TBC Class A common stock to her children, Bill Cecil and Dini Pickering, in undivided equal shares. One day later, Mr. Cecil, as trustee of his revocable trust, transferred his 9,337 shares of TBC Class B common stock, first to himself, then to his five grandchildren, subject to trusts. The Class A shares carry one vote per share; the Class B shares have no voting power. Petitioners timely filed gift tax returns for 2010, reporting the gifts and electing to split them, reporting their total taxable gifts in 2010 as $10,438,766 each. The IRS audited Petitioners’ 2010 returns and ultimately issued notices of deficiency of $13,022,552 of gift tax, taking issue with the valuation approach used by the Petitioners’ appraiser and the discounts applied.

While Petitioners’ appraiser used the income approach (which capitalizes income and discounts cash flow) and market approach (which compares the subject property with similar property subject to an arms-length sale around the same time), the IRS believed an asset-based approach (which values property by determining the cost to reproduce it, for example, by looking at the fair market value of a corporation’s net assets), was proper. The US Tax Court ultimately determined that because TBC is an operating company unlikely to be liquidated, its value is better measured by its earnings than its assets, upholding the valuation method selected by the Petitioners’ appraiser.

In doing so, the court ruled that “tax affecting” was properly applied in this case. Tax affecting is a valuation mechanism by which a hypothetical entity-level tax is applied to the taxable income of a pass-through entity such as an S Corporation. The rationale behind tax affecting is that since the income received by the shareholders is subject to income tax, such tax liability, even though not directly assessed on the pass-through entity, should be taken into account when valuing the entity. Here, although the parties’ appraisers disagreed as to the method of valuation of TBC, all agreed that the value should be tax-affected, and the court so ruled. However, the court stopped short of providing factors for when tax affecting was appropriate generally, limiting the holding strictly to the facts at hand.

The final issue determined by the court was the discounts applicable to the transferred shares of TBC. The court accepted the Petitioners’ appraiser’s 20 percent discount for lack of control while rejecting the IRS’s appraiser’s assessment of a 2 percent discount for lack of voting rights of the Class B shares (given that such shares did have voting power in limited circumstances). Finally, for lack of marketability, the court applied different discount rates depending on the class and number of shares transferred — 19 percent to the Class A common stock, 22 percent to the smaller block of Class B common stock, and 27 percent to the larger block of Class B common stock. The court held that since a smaller block of Class B shares of TBC would be more easily marketed than a larger block of Class B shares of TBC, different discount rates for these two blocks were appropriate, and since the voting rights attaching to the Class A shares of TBC make such shares more attractive to a buyer, a third discount rate was appropriate for this class of stock.

Pending Proposals From the Biden Administration

The Biden Administration released its tax proposals for fiscal year 2024 by publishing its General Explanations of the Administration’s Fiscal Year 2024 Revenue Proposals (the “Green Book”) in March 2023. Importantly, the Green Book is not proposed legislation and would need to pass through Congress like any other legislation in order to be binding. Nevertheless, the Green Book serves as “a peek behind the curtain” with respect to the priorities the Biden Administration wishes to pursue in the event the 2024 election yields favorable results for the Democratic party.

Individuals

The Biden Administration has proposed significant changes with respect to the taxation of capital gains and the taxation of accumulated wealth. For example, the Green Book proposes a return to the 39.6 percent top marginal tax rate (up from the present 37 percent), as well as increasing the net investment income tax and Medicare tax by an additional 1.2 percent each. In addition, the Green Book proposes that taxpayers whose income exceeds $1,000,000 ($500,000 for married filing separately) will be taxed at ordinary income rates for long-term capital gains and qualified dividends that traditionally are taxed at lower rates. Furthermore, the Green Book proposes a 25 percent minimum tax (inclusive of unrealized gains) for individuals whose total net worth exceeds $100,000,000 (and would further impose an annual reporting requirement on such individuals).

Corporations and Partnerships

The Biden Administration’s proposals at the entity level are largely similar to past proposals. The Green Book proposes to raise additional revenue through an increase in the corporate tax rate (from 21 percent to 28 percent). Additionally, the Green Book seeks to target corporate stock transactions, as well as address the so-called “carried- interest loophole.”

Trusts and Estates

The Biden Administration has again proposed significant changes to the areas affected by the estate and gift tax. As drafted, the Green Book would substantially change common estate planning instruments, like treating a grantor’s payment of an irrevocable grantor trust’s income taxes as a taxable gift, treating a sale to a grantor trust as a recognition event, effectively eliminating the usefulness of GRATs by having arduous requirements for the length of the GRAT’s terms and value of the remainder interest, and imposing an annual maximum of $50,000 for total annual exclusion gifts. Additionally, the Biden proposal would roll back the applicable exemption amount to pre-TCJA levels ($5,000,000 adjusted for inflation).

International Developments

With the world finally seeming to put the COVID-19 pandemic era comfortably in its rear-view mirror, this year has been characterized by everyone, including tax authorities, putting their eyes back on the road ahead. The IRS has planned its future strategy and published a roadmap of what it wishes to accomplish. Among the goals is a renewed focus on high-income taxpayers and large corporations, as the IRS has noted that these certain taxpayers often use nuanced structures involving international elements. The IRS’s ability to accomplish its planned goals has been buttressed by the Corporate Alternative Minimum Tax, which begins taking effect for tax years starting in 2023, and the CTA, which comes into effect at the start of 2024. The United States is not alone in shifting its priorities as foreign governments renew their efforts to implement a global minimum tax. Nevertheless, this renewed focus on international tax compliance and reporting across borders has come with certain growing pains in the forms of taxpayer-supported litigation. We have included a summary of the more material developments affecting the international private client landscape in 2023 and beyond.

United States and Chile Tax Treaty and Additional Tax Treaty Developments

As much as the US government and the IRS are looking forward, they have also taken up the task of progressing with items of past importance. One such item is the dual tax treaty between the United States and Chile. The US-Chile Tax Treaty was first signed more than a decade ago and has awaited US congressional approval to begin its steps toward ratification. After a long period of waiting, the Senate finally approved the treaty in June 2023, subject to additional reservations. These reservations mostly arise from changes in the US tax code introduced by the TCJA. The treaty still faces a number of hurdles before ratification, including being approved by President Biden and re-ratification of the treaty by Chile subject to the Senate’s reservations.

While the United States has moved forward with the ratification of a new tax treaty, the Russian government has suspended a number of tax treaties. Countries affected by this suspension include the US, Canada, Japan, Australia, and a large number of European Union countries. It is unknown for how long these treaties will be suspended, but it is unlikely to change without a material shift in the nature of the Russia-Ukraine war.

OECD Pillar II and the Global Minimum Tax

The ongoing process of instituting a global minimum tax continued in 2023. A number of new countries put in place laws to meet the requirements set out by Pillar II. These developments have led countries such as Switzerland to estimate that they will see increases in tax revenue of hundreds of millions of dollars, but the United States has estimated that it may see a decrease in tax revenue with the implementation of a global minimum tax. These estimated decreases in tax revenue come from a potential increase in taxes paid in countries other than the US and the accompanying foreign tax credits.

The United States’ Corporate Alternative Minimum Tax, which is effective for 2023, is grounded in similar principles to that of the OECD’s Pillar II, but it is not sufficiently similar to bring the United States into compliance with Pillar II. The United States’ lack of compliance with Pillar II and the additional difficulties that entities may experience as countries begin to implement Pillar II has led to the creation of a transitional rule for the Undertaxed Profits Rule or “UTPR,” a key aspect of Pillar II. This transitional rule states that the top-up tax in the jurisdiction of a company’sultimate parent applied by the UTPR will be nothing for each fiscal year of the transition period if that jurisdiction has a corporate tax rate of at least 20 percent.

More simply, multinationals headquartered in countries with at least a 20 percent corporate tax rate would not be subject to the re-apportioning of taxable income to other countries where they have a footprint under the UTPR. As stated earlier, this is only a transitional rule applying for fiscal years no longer than 12 months that begin before December 31, 2025, and end before December 31, 2026.

IRS Actions: Proposed Regulations and Clarifications

Like Congress and the OECD, the IRS has also been active in 2023, providing proposed regulations and clarifying points of law. With increased scrutiny of high-income taxpayers, the IRS has shifted its so-called “Dirty Dozen” list of tax scams and tax avoidance schemes to include more items used by high-income taxpayers or containing an international element. One such transaction added to the Dirty Dozen list in 2023 is the use of Maltese Retirement Plans by US taxpayers. While the use of a Maltese Retirement Plan does not per se create problems, the IRS has noted that the use of a Maltese Retirement Plan in conjunction with a position taken under the US and Malta Tax Treaty can result in US taxpayers improperly claiming certain income to be exempt from US income tax.

The proposed regulations under Treas. Reg. § 1.6011-12 would require disclosure of direct and indirect transactions with a Maltese Retirement Plan by US citizens and US income tax residents who transfer cash or property to a Maltese Retirement Plan. This disclosure requirement would also include US taxpayers who receive a distribution from a Maltese Retirement Plan and take a position on their federal return that income or gains from such distributions are not includible in their income under the US and Malta Tax Treaty. The Proposed Regulations include an exception to the disclosure rules for individuals using a Maltese Retirement Plan under certain circumstances; however, this exception is planned to be phased out after a currently undetermined applicable date.

Outside of the Proposed Regulations, the IRS has published Advice Memorandum 2023-003 providing further clarification on the Publicly Traded Stock Exception for a US Real Property Holding Corporation or “USRPHC” in Code § 897(c)(3). This exception allows individuals who own less than 5 percent of a class of publicly traded stock of a USRPHC to avoid such stock being treated as a US Real Property Interest. Gain resulting from the disposition of a US Real Property Interest by a non-US taxpayer is treated as effectively connected income and taxed at graduated rates. The Advice Memorandum clarifies this point when interests in a publicly traded USRPHC are owned through a foreign partnership by applying the 5 percent rule at the partnership level under an entity theory of partnerships. Therefore, if a foreign partnership owns more than 5 percent of a publicly traded USRPHC, gain from a disposition of such USRPHC interest will be considered ECI to the partners.